\In this Afrimex Gold review, we’ll take a closer look at the platform’s legitimacy, investment risks, and whether it’s a scam or a legitimate opportunity. With promises of high returns and gold trading services, Afrimex Gold has attracted many investors. However, this Afrimex Gold review will uncover the red flags and risks you need to know before investing.

The total lack of transparency surrounding Afrimex Gold’s ownership is a serious red flag. The website doesn’t reveal:

Who runs the platform or owns it.

Any formal business registration information.

A physical office address.

The domain was created on October 12, 2019, making it over five years old. While an older domain can suggest stability, it is not a guarantee of legitimacy.

Afrimex Gold claims to offer high monthly returns, often ranging between 10% to 20%. However, such returns are mathematically unsustainable. For example, a $1,000 investment with a 15% monthly return would grow as follows:

Month 1: $1,150

Month 6: $2,313

Month 12: $5,350

Such exponential growth is unrealistic and often indicative of Ponzi schemes, where returns are funded by new investors rather than genuine profits.

Reviews are mixed. Scamadviser assigns a trust score of 71 out of 100, indicating “medium to low risk.” Scam Detector rates it 60.4 out of 100, highlighting potential concerns. Scamdoc offers a higher trust score of 90%, but the absence of detailed user reviews makes it difficult to assess the platform’s reputation accurately.

The website uses a valid HTTPS connection, ensuring encrypted data transmission. However, there is no evidence of third-party security audits or verified smart contract assessments, which are essential for ensuring the platform’s reliability.

The website does not specify accepted payment methods, and platforms that only accept cryptocurrencies pose higher risks due to the anonymity and irreversibility of transactions. Additionally, the lack of comprehensive contact details, such as email addresses, phone numbers, or physical addresses, is a red flag.

Real Estate ROI: Average annual returns typically range between 8% to 12%.

Bank Savings Accounts: Annual percentage yields (APY) usually range from 0.01% to 0.06%.

Legitimate Crypto Exchanges: Annual yields for staking programs generally range between 3% to 10%.

The ROI claims made by Afrimex Gold far exceed these traditional investment returns, which is a significant red flag.

Anonymous Ownership: No information about the team or founders.

Unrealistic ROI Promises: High returns that are mathematically unsustainable.

Lack of Independent Audits: No verifiable security or financial audits.

Minimal Online Presence: Low traffic and limited public engagement.

Incomplete Platform: The website lacks comprehensive information and functionality.

Always research before investing. Use these tools to verify legitimacy:

WHOIS Lookup: https://whois.domaintools.com

SimilarWeb: https://www.similarweb.com

ScamAdviser: https://www.scamadviser.com

Trustpilot: https://www.trustpilot.com

Reddit Discussions: https://www.reddit.com

After a thorough analysis in this Afrimex Gold review, it’s clear that the platform exhibits multiple red flags, including:

Anonymous ownership.

Unrealistic ROI claims.

Lack of independent audits.

Minimal online presence.

Investors should avoid Afrimex Gold and consider safer, more transparent alternatives.

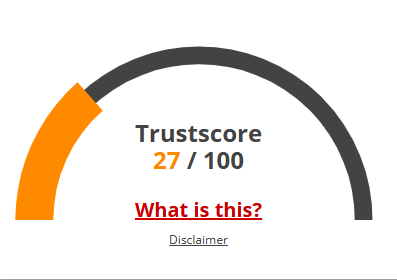

bnbdapp.io has a low trust score. The website may be a scam.

Scamadviser gave a low review to bnbdapp.io based on several data points we were able to find online (such as reviews on other sites, phishing reports and public data such as the address of the company and server).

The rating of the website seems low. Our automatic analysis may however be wrong and bnbdapp.io may be legit and safe. It is recommended to always do your own check as well.

In this Afrimex Gold review, we’ve analyzed the platform as a gold trading and investment service. However, its lack of transparency and unrealistic ROI claims raise serious concerns about its legitimacy.

Based on our Afrimex Gold review, the platform exhibits multiple red flags, including anonymous ownership, unsustainable ROI claims, and lack of third-party audits. Investors should exercise extreme caution.

Our Afrimex Gold review highlights several risks, such as:

Loss of Funds: High chances of losing your investment due to potential scams.

Lack of Transparency: No verifiable information about the team or business registration.

Withdrawal Issues: Many users report delayed or denied withdrawals.

As explained in this Afrimex Gold review, the platform claims to offer 10-20% monthly returns, which are mathematically unsustainable. Such returns are typical of Ponzi schemes, where new investors’ funds are used to pay older investors.

No, our Afrimex Gold review found no evidence of third-party audits from reputable firms like CertiK or Hacken. This lack of verification raises serious concerns about the platform’s security and legitimacy.

Title : Afrimex Gold | Ghana

https://scamsradar.com/zmexaie-com-review-is-it-a-legit-investment-or-a-scam/

https://scamsradar.com/boosterapp-ai-review/

https://scamsradar.com/apexfunds-net-review-scam-or-legit-investment/

https://scamsradar.com/delle-investment-group-review-a-generic-fintech-ponzi-scam/

https://scamsradar.com/coinplutus-com-review-a-deep-investigation-into-its-legitimacy/

There are no reviews yet. Be the first one to write one.