Online platforms often lure investors with the promise of large profits with little work. www.Mauna.Fund is one such website that advertises daily returns between 3.3% and 3.9%. By looking at a number of important factors, including as business ownership, website traffic, public perception, security protocols, content validity, payment methods, customer service, technological performance, return on investment promises, and other red flags, this research seeks to evaluate Mauna.Fund’s credibility.

As a low-entry FinTech investment fund, Mauna.Fund focuses on facilitating the smooth transfer of funds across three revenue streams: preIPO businesses, NFT indices, and over-the-counter trading. Nevertheless, the website is opaque about who owns it and who its main proponents are. No facts on business registration or legal status are provided, nor are there any specifics about the people or organizations in charge of running the site. It is difficult to evaluate the company’s credibility in the lack of reliable evidence, which also raises questions about responsibility.

It is difficult to get precise visitor data for Mauna.Fund, such as traffic volume, trends, and the top countries from which visitors visit the website. It is challenging to do a thorough assessment of the platform’s audience engagement and reach due to this data shortage. Furthermore, the site’s reputation is not well-established across web analytics systems, which makes evaluating its reliability even more difficult.

The public’s opinion on Mauna.Fund is divided. While some evaluations raise doubts about the platform’s credibility, others emphasize its investment plans and possible rewards. For example, a review on HYIP.biz highlights the inherent hazards of such sites while also pointing out the possibility of doubling investments in less than two months. Furthermore, there is a YouTube video called “Mauna Fund Scam Alert! Alerting visitors to any fraudulent activity linked to the platform, “Here’s What You Need to Know.” These conflicting assessments highlight how crucial it is to carry out extensive research before using the platform.

An SSL certificate is one of the common security techniques used by Mauna.Fund to encrypt data sent between users and the website. Nevertheless, the website is devoid of comprehensive details about its data security procedures and encryption techniques. It’s difficult to evaluate the platform’s dedication to protecting user data in the absence of thorough security disclosures.

Several issues are raised by a review of Mauna.Fund’s content:

These problems point to a lack of professionalism and openness, two qualities that are essential for winning over potential investors.

Regarding its return policy, payment industry standards compliance, and payment methods, the website doesn’t provide clear information. Concerns over the platform’s financial transparency and possible transaction risks are raised by the lack of this crucial information.

Information on the availability and responsiveness of Mauna.Fund’s customer support channels is not easily accessible. For investors looking for help or a solution to problems, the absence of easily available support services might be a major disadvantage.

There is no precise information on the website’s uptime, technical stability, or loading speed. It is difficult to evaluate the platform’s dependability and user experience thoroughly without this information.

Mauna.Fund claims daily returns of 3.3% to 3.9%, which adds up to more than 1,200% in yearly returns. Returns this high are unattainable and much out of line with industry standards. It is regarded as extraordinary in conventional financial markets to consistently generate yearly returns exceeding 1015%. The platform’s claimed returns are evocative of Ponzi schemes, in which the cash of new investors is used to pay returns to previous investors instead of profit from the operation of a legal firm.

A number of warning signs point to possible fraudulent activity:

Potential investors must be very cautious in light of these red flags.

Mauna.Fund and other high-yield investment programs (HYIPs) often function similarly to Ponzi schemes by luring investors with unsustainable returns. Such schemes have historically had a short lifetime; they usually fail within a few months to a year when the amount of new contributions received is inadequate to provide returns to previous participants. There is a considerable chance that Mauna.Fund may soon become unsustainable, given that it was introduced on November 22, 2024, and the average longevity of projects of this kind.

According to the investigation, Mauna.Fund has a number of traits that are often seen in fraudulent platforms. Negative customer reviews, inflated ROI claims, and a lack of transparency are serious issues. It is highly recommended that investors do comprehensive due diligence and take into account the following suggestions.

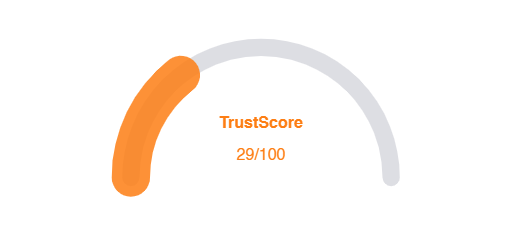

Given Mauna.Fund Very low trust score, there is a good chance that the website is a hoax. Use caution when accessing this website!

Our algorithm examined a wide range of variables when it automatically evaluated Mauna.Fund, including ownership information, location, popularity, and other elements linked to reviews, phony goods, threats, and phishing. All of the information gathered is used to generate a trust score.

There are no reviews yet. Be the first one to write one.